The success or failure of any strategy lies not only in the strategy itself, but also in the execution of the strategy. The success or failure of any partnership strategy lies not only in the strategy itself, but in the coordinated execution of the strategy by two or more companies.

So, what’s the first step to ensuring successful execution with a partner? Choose wisely. In a cross-industry study, alliance professionals reported that 34% of partnership failure is a direct result of decisions made at this stage – either selecting the wrong partner(s) and/or setting conditions that are not conducive to success.

For many market opportunities, there are multiple partners who could fulfill the objectives of the collaboration (e.g., increasing access to customers, building a new solution). Choosing the best partner is challenging – you need to figure out what criteria to use, parse the likely outcomes with multiple companies and combinations of companies, and align internal stakeholders around a decision (oh, and cognitive biases are likely to get in the way). Not surprisingly, the companies who realize the best results from their partnerships utilize a systematic approach to making this decision.

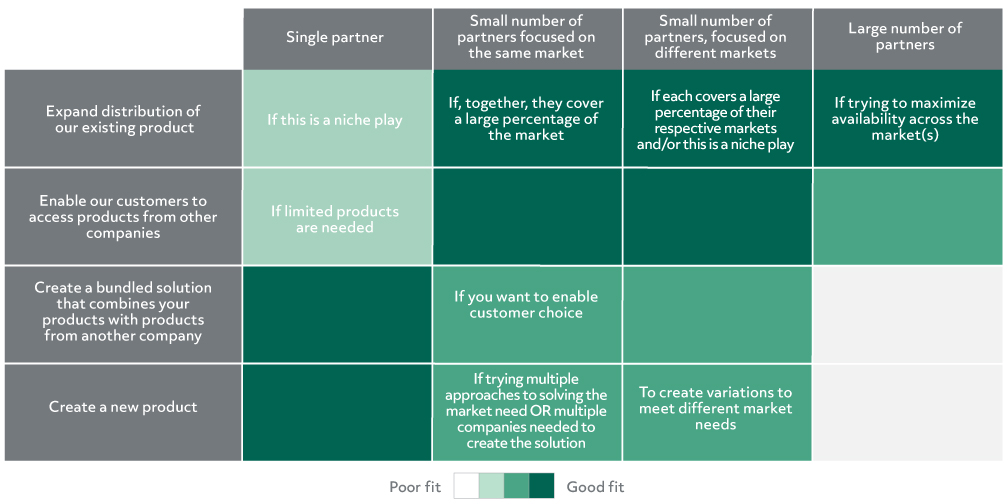

Strategic options

Sometimes it makes sense to select a single partner, other times it is better to have a variety of partners to accomplish the same strategic goals. Before evaluating potential partners, executives need to evaluate what sorts of partnership strategies might make the most sense in this situation. Below are some options…

Potential Partner Comparison

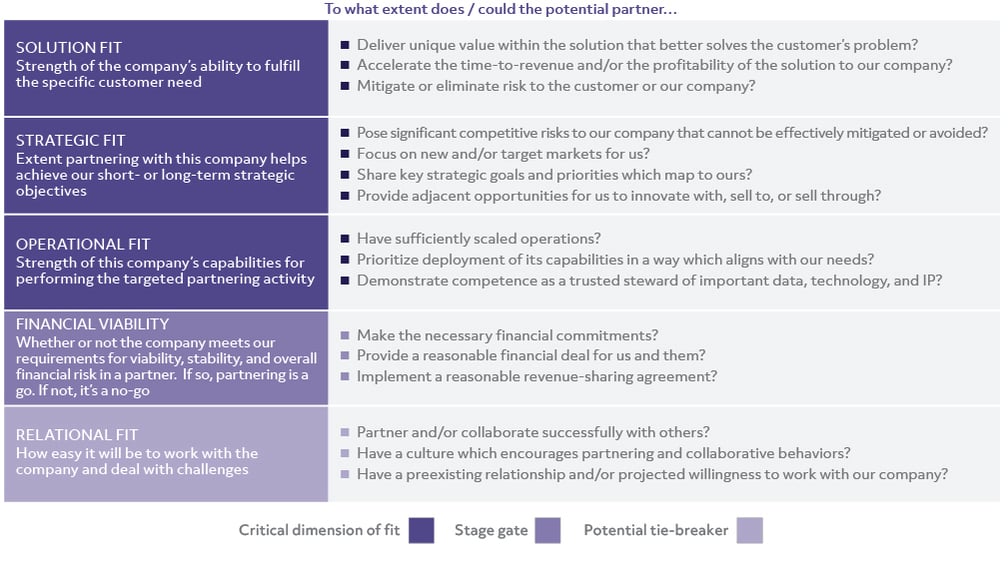

Once you’ve determined the right partnership strategy for your opportunity, you can turn to comparing potential partner targets. A systematic, fact-based comparison of your potential partners enables all stakeholders to articulate their views, and focus discussion where there are differences of opinion. Below is a Potential Partner Comparison Tool that many companies use to assess the relative capabilities and fit of each potential partner, as well as potential execution challenges and opportunities given the reality of the companies involved (increasing the likelihood that once the partners are in “execution mode,” expectations are appropriately set and the right mechanisms have been put in place to manage any major challenges).

The tool examines five key dimensions of selection criteria:

- Solution Fit: Indicates the strength of the company’s ability to fulfill the specific customer need

- Strategic Fit: Indicates the extent to which partnering with this company helps achieve our strategic objectives. While the purpose of this criterion is to determine the fit of a partner on a specific (near-term) opportunity, it is also important to consider longer-term strategic implications and opportunities of the partnership.

- Operational Fit: Indicates the strength of this company’s capabilities for performing the targeted partnering activity

- Financial Viability: Indicates whether or not the potential partner meets specific requirements for viability, stability, and overall financial risk in a partner.

- Relational Fit: Indicates how easy it will be to work with the company and deal with challenges. It can inform how you execute the partnership

As you see in the graphic, the criteria are listed in order of importance. Solution fit, strategic fit, and operational fit are considered a “critical dimension” for partnership fit (i.e., should be weighted more significantly than all other criteria). Financial viability is considered a “stage gate” and relational fit is used only as a “tie breaker” when two or more partners are not well differentiated in the other categories. Assign a rating across these five categories (e.g., 1=not a fit, 2=low fit, 3=moderate fit, 4=good fit, 5=strong fit). Once you have assigned a rating across all five categories, state a conclusion about the potential for partnering, including strategic implications (e.g., “this is our best choice, because …” or “Partnering with X company would only work if…”).

How do you acquire the information to assign a rating for a potential partner across these categories? Often the information you need is publicly available in press releases, annual reports, and/or industry reports; additionally, you should consult data stored within your CRM and other account management tools, as well as you and your colleagues’ general knowledge of the company. All of this data can help inform ratings, and a lot will come down to judgement from your internal stakeholders and decision-makers. Using a tool like this one does not eliminate human judgement or biases, but it does do two critical things:

- Breaks opinions down to a level of concreteness that enables decision-makers to quickly identify why they disagree, and focus their discussion on areas of disagreement

- Creates a record of why the company is choosing a particular strategy, which can help maintain alignment and/or pivot later when new information becomes available

This piece is part of our Fintech and Financial Services series.

Authors:

.png?width=512&height=130&name=vantage-logo(2).png)